The long struggle over taxing the rich

States’ taxes lean most heavily on poorer residents. These states are trying to change that.

‘Audacious’ tax relief plan advances at Hawaiʻi Legislature

The biggest proposed savings are in a bill from Gov. Josh Green that would boost all Hawaiʻi income tax bracket thresholds and increase the standard deduction along with the personal exemption.

Move ahead with care on tax relief

Legislators must ensure that the relief package makes the most of state resources, finding the right balance of lower taxes and the services that Hawaiʻi’s people need most.

The five best tax ideas coming from governors this year

One of the clearest trends in state tax debates this year is the continuing momentum toward new and better tax credits for workers and families.

Will the states finally tax the rich?

Lawmakers in seven states last month introduced legislation that aims, in some innovative ways, to raise taxes on their most fiscally favored.

Want to give our kids a future? Change the way we tax wealth

Enhanced revenue should come from those who can afford to pay more including large corporations and out-of-state investors.

A ‘wealth asset tax’ on Hawaiʻi’s richest residents advances in the legislature

The new tax would apply to people with a net worth of more than $20 million.

Hawaiʻi bill looks to increase capital gains taxes

A new bill in the state legislature is looking to tax these investments like regular working income.

A national wealth tax has gone nowhere. Now some states want to tax the ultra-rich

Each state has its own approach for taxing the rich, but typically the strategies include taxing assets as well as lowering the threshold for estate taxes.

Tax the rich? Liberals renew push for state wealth taxes

Supporters of taxes on the very rich contend that people are emerging from the COVID-19 pandemic with a bigger appetite for what they’re calling “tax justice.”

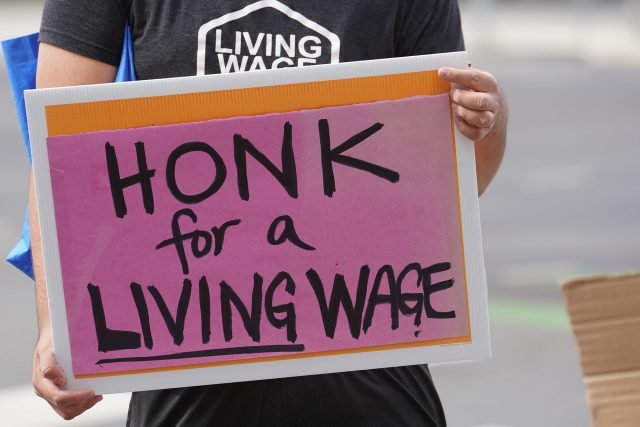

Hawaiʻi Tax Fairness Coalition protest at state capitol in favor of new tax on ultra-wealthy

The coalition is proposing new taxes on the ultra wealthy, and more tax relief to the low and middle income residents.

State progressives launch coordinated push to raise taxes on the rich

A coalition of left-leaning state legislators announced a new effort Thursday to tax the richest Americans, simultaneously introducing bills across eight states.

Tax-the-rich blue states want to leave wealthy ‘nowhere to hide’

Progressive lawmakers in a handful of blue states joined forces Thursday in a campaign to fire up energy for tax-the-rich policies in state capitols.

Billionaires in blue states face coordinated wealth-tax bills

Some measures are based on Sen. Elizabeth Warren’s proposals to make the super-rich pay more

Hawaiʻi lawmakers finally agree on raising the minimum wage

House Bill 2510 also makes a state earned income tax credit refundable. Meanwhile, many taxpayers could soon get a $300 tax rebate.

How the legislature can help ALICE families

The EITC is far more effective as both a household budget lifeline and as an economic stimulus when it is fully refundable and puts cash directly in the hands of families that need it most.

Capital gains tax increase and a new carbon tax may not make the cut

With all 76 members of the legislature up for reelection, lawmakers are expected to shy away from those potentially controversial tax measures this year.

State tax bill could have major impact on Kauaʻi

A bill in the state legislature could potentially mean more money in the pockets of working families on Kauaʻi.

Legislators consider extending income tax credit for struggling families

Every dollar a tax filer gets from the EITC generates another $1.24 in economic activity. This type of tax refund can act as an economic stimulus for the state.

Working families deserve permanent earned income tax refund

When all working families are able to permanently access the full value of the Earned Income Tax Credit, communities across our state will become stronger and better prepared for the many challenges that lay ahead in the 21st century.